Stagnating attendance, high fixed costs, and mounting debt have long challenged the exhibitor industry. Consumer habits have continued to change as home theater equipment has become more affordable and newer streaming and video-on-demand (VOD) options have entered the marketplace. In addition, streaming and VOD companies, with high amounts of cash to spend, have begun to create their own content or directly compete with exhibitors for access to movie titles from studios, which has precipitated a significant decline in ticket sales.

The impact of the COVID-19 global pandemic, too, has sent shock waves through the industry, with customer preferences shifting away from large social gatherings, drastically accelerating the timeline for needed changes. From an operational perspective, reduction in theater capacity to meet physical distancing requirements will reduce revenue potential from ticket sales because it is unlikely that exhibitors will be able to pass along price increases to make up for the reduced number of moviegoers. Especially given the lesser relative risk of virus exposure at home and growing lists of streaming and VOD alternatives, moviegoers might not rush to pay higher ticket prices at movie theaters anytime soon—even for a premium experience.

The pandemic will assuredly continue to negatively affect the industry in the near term. In such an environment, major industry players could be at risk of not meeting debt obligations and/or not maintaining covenant compliance and will need operational changes and cooperation from lenders to reduce insolvency risk. To survive in the face of such changing dynamics, major consolidations are required, with larger exhibitor companies levering up to buy competitors and with small, independent theaters needing to stave shrinking margins from reduced capacity and additional cleaning requirements—and associated expenses—necessary to attract customers.

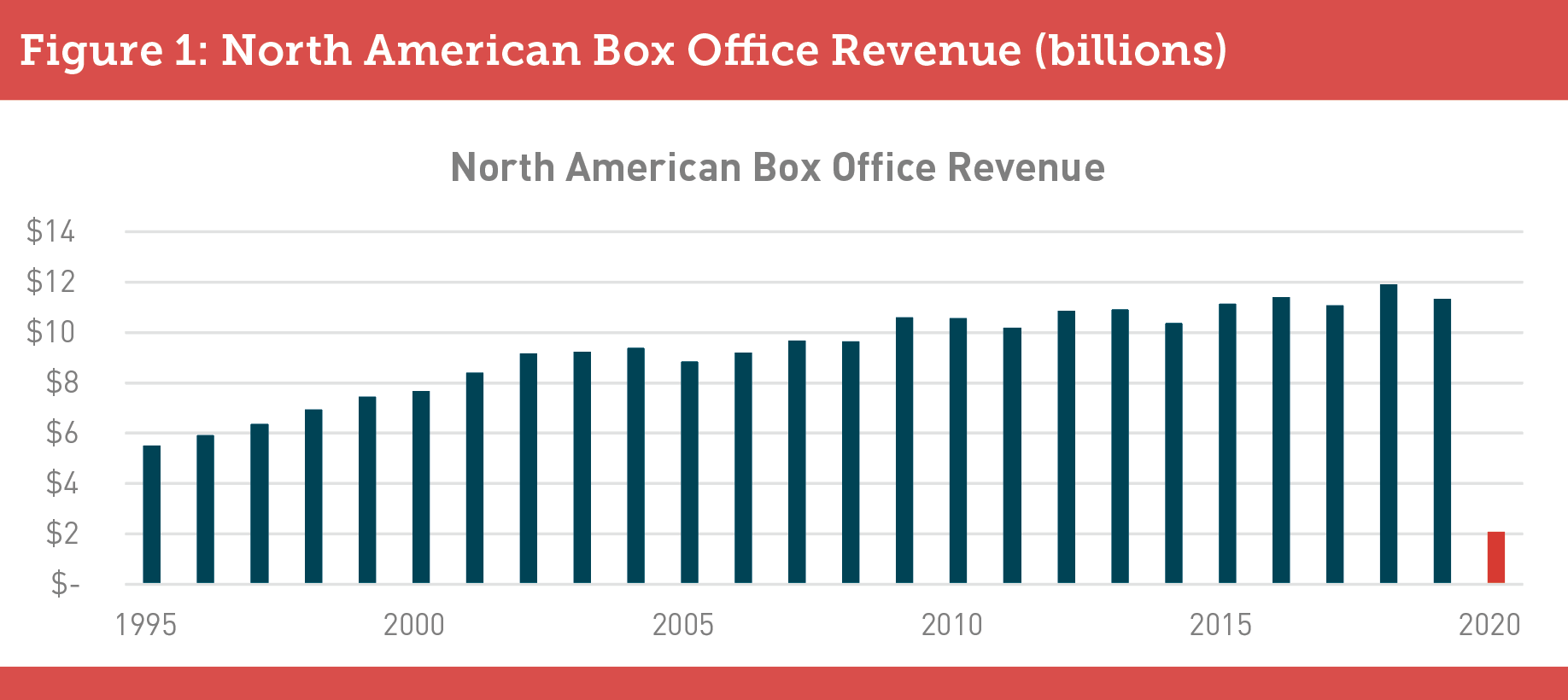

Prior to the pandemic, the exhibitor operating model itself was going through a transformation, with theaters moving toward a lower-volume, premium experience to account for a shrinking customer base. In addition, there is no question that COVID-19 significantly affected the exhibitor industry in 2020. Exhibitor revenue declined by 82% year over year in 2020 (Figure 1).

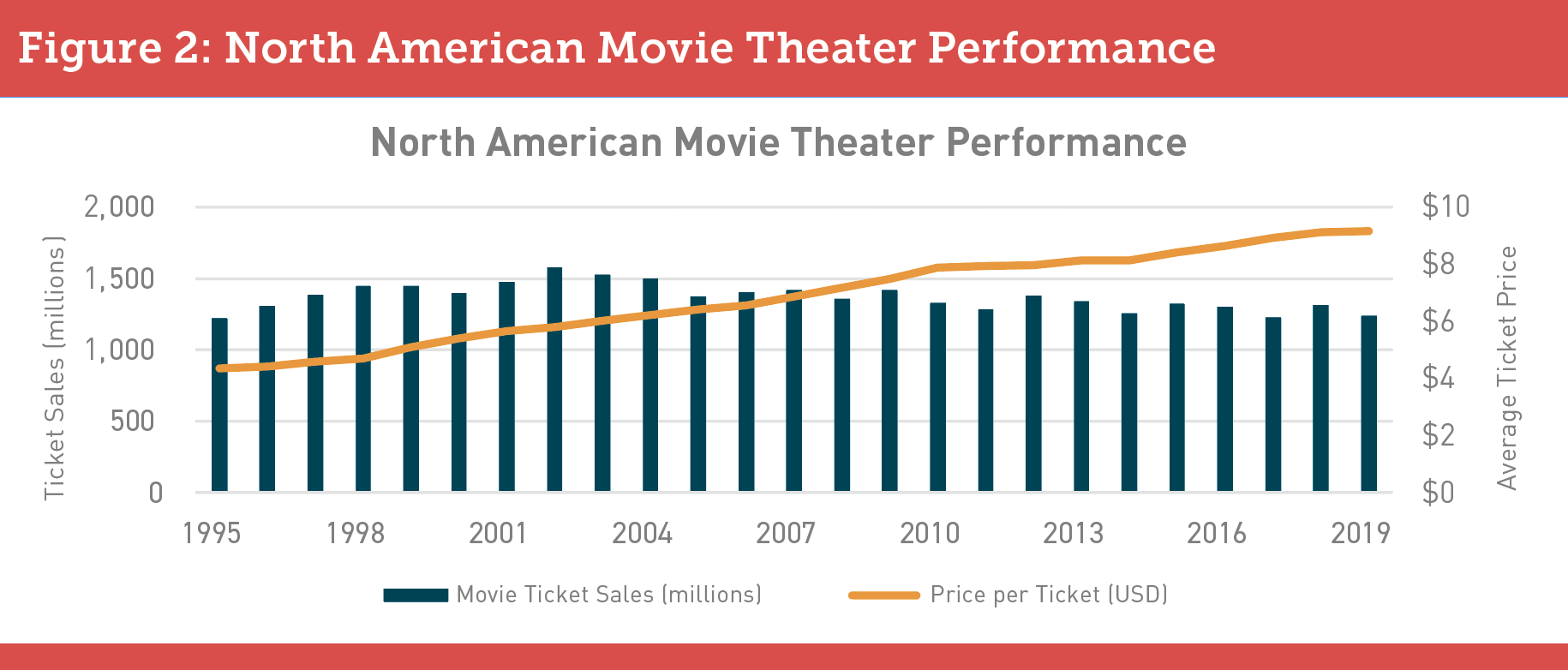

Even before the pandemic, the number of movie tickets sold has been consistently declining and is currently at a multidecade low—at a level similar to that in 1995. In response, exhibitors have shifted toward a more premium viewing experience that offers better technology—with optimized seating to justify increased ticket prices—and more premium food and beverage offerings. That said, the average ticket price at North American movie theaters increased only slightly above inflation, growing at a 3.3% compound annual growth rate, from $4 in 1995 to $9 in 2019 (Figure 2).

The number of movie screens per capita has decreased, and the total number of screens in the United States has flatlined for almost a decade now, suggesting that the industry has reached maturity. Although construction efforts to build new multiplex theaters continue, for the most part such new screens are replacing older locations, which are being shuttered because of low traffic and significant costs to upgrade them.

Streaming and VOD options and exhibitors are increasingly competing for consumers’ wallet share and time against other entertainment offerings. The improvement of home video services through the use of better technology and higher internet bandwidth speeds has enhanced the experience of watching a movie at home, and so, consumers can now achieve a home experience similar to what is offered at traditional exhibitors. Currently, 50% of U.S. adults go to a movie theater only once a year or not at all. Comparatively, 50% of U.S. adults watch or stream movies at home several times a week. The gap in viewership points to the inertia that many people feel about going to movie theaters.

Unit economics of the movie exhibition business have exacerbated these headwinds. A movie exhibitor’s cost structure is almost entirely fixed—with expenses consisting of rent, utilities, employee costs, and long-term movie distribution rights—whereas revenues are variable and dependent on foot traffic into theaters.

Despite the negative industry trends, film releases during the COVID-19 pandemic suggest exhibitors still have a major role to fill when it comes to big-budget releases. With many blockbuster-film budgets exceeding $150 million, movie production houses and studios need a mass distribution platform to make their economic model work. In 2019, the top 10 domestic releases topped $3.6 billion in box office revenue, earning 40 to 50% gross profits for the studios. Without the mass distribution platform of the more than 40,000 screens in the United States, it would have been difficult to achieve that.

In a study conducted to learn the feasibility of forgoing typical theatrical releases in favor of a premium video-on-demand (PVOD) direct-to-home release, LightShed Partners estimated that a PVOD-only release would require studios to sell 16 million to 21 million units at a $30- to $40-per-unit price point just to break even. As a point of reference, the largest pay-per-view event in history was 2015’s Floyd Mayweather vs. Manny Pacquiao boxing match, which sold 4.4 million units at about $90 per unit. Disney released “Mulan” on March 25, 2020, at $30 per unit, and the film is estimated to have grossed less than the film’s $200 million production budget.

More recently, some studios like Warner Bros. Pictures have released films straight to their VOD platform to varying levels of success; however, since the pandemic began, most studios have opted to push planned big-budget releases to the second half of 2021 in hopes of big box office earnings post-pandemic. It is likely that exhibitors will continue to maintain leverage at the negotiating table with studios based on the value proposition regarding big-budget blockbuster releases.

Advertisers and food and beverage producers also rely on the theater industry. In 2019, ads shown before movies generated $4.6 billion—a growth of 6.8% over the previous year—which made this form of advertising the fastest-growing traditional ad format in the world. Advertisers are increasingly drawn to this format because of the captive nature of the audience and the assurance that ads won’t be placed next to controversial content.

Food and beverage sales are also significant in theaters, generating nearly $5.7 billion in sales in the United States in 2019. Movie theaters represent a significant source of revenue for beverage distributors like Coca-Cola and Pepsi, which cannot be easily replaced by the market for digital streaming and home viewership.

In the near term, exhibitors should focus on implementing measures that will preserve liquidity, maintain economic viability, and set themselves up for long-term profitability. Specific actions to achieve those goals could include:

The post-pandemic world that exhibitors face will likely include both opportunity and uncertainty. A flood of major motion pictures set to be released in 2021, combined with pent-up consumer demand, could be a major boon to business. However, studios and consumers will likely continue moving toward more in-home movie viewing experiences. The exhibitor that can most effectively and most expeditiously return to normalcy post-pandemic while also implementing creative remedies to long-term industry headwinds will be best positioned for long-term success.

Seating. In the short run, movie theater seating arrangements need to change to make visitors feel comfortable given COVID-19 and the new physical-distancing norms. One option is to put in place more-modular seating arrangements that can act as physical-distancing tools. Seat materials, too, would need replacement from vinyl or cloth to materials that can be disinfected on a regular basis, which would offer exhibitors longer-term flexibility in their hosting of different events at certain times and days to ensure optimal capacity utilization.

Modularization of theater and seat setups could enable the space to be shaped into a sports bar-like atmosphere for live events and adjusted for varying levels of physical distancing, depending on pandemic developments. The following are some incremental offerings beyond film watching that theaters might employ to increase their bottom line:

In a post-pandemic world, expanding the scope of service offerings to compete with live events, such as concerts, performing arts, debates, and sports, may give access to a larger revenue pie—and could help offset potential revenue declines in legacy movie theater operations.

Concessions. Food and beverage sales account for an estimated 30% of the movie exhibitor industry’s revenues. Concessions generally command higher margin than admissions and therefore drive a greater share of profits. Typical concessions have included soft drinks, candy, popcorn, and similar basic snack items, but theaters in the run-up to the pandemic were trending toward expanding their offerings to a more full-service dine-in experience of entrées, snacks, and full bar menus.

Although it’s still too early to tell how consumer preferences will shift in light of changes to hygiene culture post-COVID—and whether those shifts will sustain over a longer period of time—it’s unlikely that patrons will continue purchasing such items as large popcorn buckets to share with others, thereby making communal butter machines relics of the past. In that regard, premium customizable food options for individuals may not only meet the new hygiene demands but also increase profits by means of increasing higher margin premium concessions as a percentage of total revenue.

Early estimates from post-COVID reopenings have indicated that demand for concessions and alcoholic beverages at theaters remains high, with spending per customer in line with historical levels. In areas that experienced extended stay-at-home orders during the pandemic, recovery from a sudden demand shock could propel a boom in dining out, which would indicate that customers may be more comfortable spending on high-margin concessions when they return to theaters. A comprehensive rethink of the dining experience at theaters could result in incremental earnings even if movie theater traffic were to remain lower than pre-pandemic levels.

Titles. Film studios are increasingly creating their own content distribution channels (e.g., Disney+) and partnering with streaming and VOD operators like Netflix and Amazon to circumvent the typical exclusivity enjoyed by exhibitors. Given the optionality that this new paradigm gives the viewer, exhibitors together with production houses will have to be more judicious in working together to release movies that will offer more premium moviegoing experiences without pricing out the average viewer.

In a possibly precedent setting move, AMC and Universal announced an agreement in July 2020 that gives Universal the right to move its films to VOD in as few as 17 days. Historically, AMC maintained exclusive rights to a film for at least 30 days. The agreement will reduce the amount of time a Universal film is exclusively in theaters but will permit AMC to share in the VOD revenue streams. Exhibitors should look for similar opportunities with studios, which would create new revenue opportunities in midtier productions while maintaining their competitive position in big-budget films.

Smaller, independent films that were already less profitable to exhibitors pre-COVID could go straight to VOD because exhibitors are unlikely to offer better terms to content producers during a recovery—especially when compared with the cash burn by the major VOD distribution channels. In addition, content producers that have had to delay releases have built up large content inventories during the pandemic and may therefore find it difficult to produce expensive 3D/IMAX-like, big-budget movies in the near future. In this environment in which content is hard to come by on both ends of the spectrum, the lack of content supply will further exacerbate the need for alternate content media to be screened by exhibitors.

To tackle these challenges during the transition to the new normal, exhibitors can follow a step-by-step transformation playbook.

Now more than ever, cash is king. Not only should exhibitors manage cash to improve liquidity for day-to-day operations, but they should also seek to free up otherwise trapped resources they’ll need for investing in transformational initiatives to position themselves for the future. Exhibitors will also have to take a thoughtful approach to developing new product and service offerings, making incremental investments, and managing cost reduction plans. Exhibitors will have to establish cash cultures to achieve that, and cash management expertise is vital to developing the requisite tools and processes.

Exhibitors also should conduct a four-wall analysis to determine how to apply scarce capital in areas best suited for the future needs of a targeted consumer base. Leveraging that analysis, an advisor can help support negotiations with landlords to seek equitable outcomes until a final state is determined. The negotiations might include taking a profit-sharing approach in which uncertainty is balanced between two parties.

Finally, exhibitors must determine the right long-term capital structure for new normal operations so they can achieve attractive returns while retaining enough cushion for sound financial management. Transitioning to an optimal structure will require engaging with lenders, sponsors, and other stakeholders to develop effective solutions.

Also contributing to the preparation of this article was Steve Spitzer, managing director, in AlixPartners’ Turnaround & Restructuring Services practice.