Q: How did you gravitate into turnaround/restructuring work?

HUGHES: When I was a field examiner at American National Bank and Trust Company of Chicago, I found that I enjoyed performing the collateral reviews for the asset-based lending and workout divisions of the bank. The general lending clients that performed well and were not highly leveraged were boring assignments, and the reports were not interesting to write.

I also assumed that the loan officers found the reports technical and boring.

So, I asked my manager to stop sending my audit reports to the loan officers through interoffice mail. I saw an opportunity to provide personal service and preferred to make an appointment with each loan officer to review the report. I found they appreciated that personal touch.

When the bank decided to add staff to their workout department, the head of the asset-based lending division suggested that they interview me instead of hiring from the credit analyst training pool, which was the typical method of developing new loan officers. My expertise in evaluating collateral and the personal attention helped me achieve the promotion to a loan officer in the workout department.

I made a career change in 1995 to join Finova Capital Corporation, where my final role was the vice president of portfolio, audit, and operations in the Healthcare Finance Division, a startup line of business that grew from $60 million to $1 billion in commitments over five years. It was very fast and dynamic growth, which many lines of business within the company experienced.

However, Finova also experienced some financial challenges as a public company. After unsuccessful attempts to find a buyer for all or part of the company, Finova filed bankruptcy.

When I left Finova, I was going to take a year off and figure out what I wanted to do next. However, I only lasted three months. It was probably poor timing to start this experiment in January in the Midwest. So, I called Mike Eber and Pat Cavanaugh, the founders of High Ridge Partners, to inquire about who might be hiring and seek career advice. Mike was a division manager at American National Bank, and I got to know Pat through his work as a turnaround consultant. They invited me to join their firm, and that’s how I became a turnaround consultant. This is another example of how effectively utilizing networking and personal relationships with key people helped me progress in my career.

Q: What were some of your most gratifying, favorite, or important cases along the way?

HUGHES: One of my most gratifying and proudest moments was in 2017, when High Ridge Partners was awarded the Small Transaction of the Year Award by the TMA Chicago/Midwest Chapter for work on an engagement where I led the team with respect to an assignment for the benefit of creditors of Adjustable Clamp Company, better known as Pony Tools. It was a collaborative team effort and award that included Pat Cavanaugh of High Ridge Partners as the assignee for the benefit of the creditors; Harold Israel, now with Levenfeld Pearlstein, as counsel for the assignee; Bryn Perna, now with Wintrust Bank, as the secured lender; and Susan Silver of Millennium Properties as the real estate broker. This was definitely a gold

medal caliber team!

We were able to pay off the secured lender within 60 days, and shortly thereafter, we paid all the priority unsecured claims in full. Approximately one year later, we were able to make a distribution of approximately 73 cents on the dollar to the general unsecured creditors. This was achieved by selling the two divisions of the company, one operating and one shuttered, and three separate buildings and parking lots through creative and successful assignee auctions.

Q: What key milestones in your career helped make you the professional you are today?

HUGHES: I think that starting as a field examiner performing collateral reviews provided a solid foundation for understanding secured lending. There was also the challenge of being able to quickly assess and understand the quality and accuracy of client-provided financial reports or other information to determine if they had provided the information I was seeking. Obviously, borrowers attempt to hide their flaws, and it was my job to find them and mitigate risk for the bank.

I also worked on the team to provide due diligence information to prospective buyers of the Healthcare Finance Division of Finova. This provided a foundation for understanding how prospective buyers evaluate due diligence materials and the various reports that may be required in a data room. I am dating myself, but at that time, I actually sat in the data room to explain reports and information and assist prospective buyers in reviewing our credit files.

Finally, HRP has managed or provided advisory services for more than 300 sale transactions. These transactions include operating and non-operating businesses’ assets and intellectual property.

Q: What role has your TMA membership played in your career?

HUGHES: I was a member for many years but decided to start engaging more with the organization through the TMA Network of Women (TMA NOW).

I volunteered for committee work and joined the NOW Committee in a leadership role for a few years. Since that time, I have been a co-chair for other committees, and I became a board member almost three years ago. This involvement has helped me to develop a stronger network not only for referrals but for information sharing and friendships.

While we all network for new business referrals, the ability to develop a strong foundation of people with whom I may explore ideas, options, and creative solutions for clients is as valuable. My network of resources has truly been enhanced through the TMA, and I am hopeful that others perceive me as such a reference for them, too.

Q: What advice do you have for someone who is new to the industry or is thinking about getting into the industry?

HUGHES: I tell them to join the TMA, of course. The TMA provides a great opportunity to network and find out who’s hiring within what role. I also think that they need to develop a strong elevator speech to help people quickly understand what they are seeking and what they have to offer.

There’s a pretty steep learning curve in this specialized industry. If you’re starting your career, try to join a lending institution through their credit analyst training program or become a field examiner, or seek a junior role at an investment banking firm to get exposure to underwriting and deal structures. If you’re experienced in your field, seek out the leaders that are doing the tough deals and develop a mentoring or networking role with them. Successful turnarounds are always a team effort, and if you demonstrate that you are pleasant, knowledgeable, creative, and capable, I would want you on my team!

I am also honest with them that this can be a high-stress, high-energy, and time-consuming career. We are sometimes referred to as crisis managers. Crisis usually indicates a short timeline and potentially serious consequences. I think people need to understand that it may not be the role for everybody. I’ve seen people who have tried to work in this industry and did not succeed because they did not handle stress well.

Q: What are you passionate about outside the office?

HUGHES: I play pickleball and spend as much time as possible playing with and training my dogs.

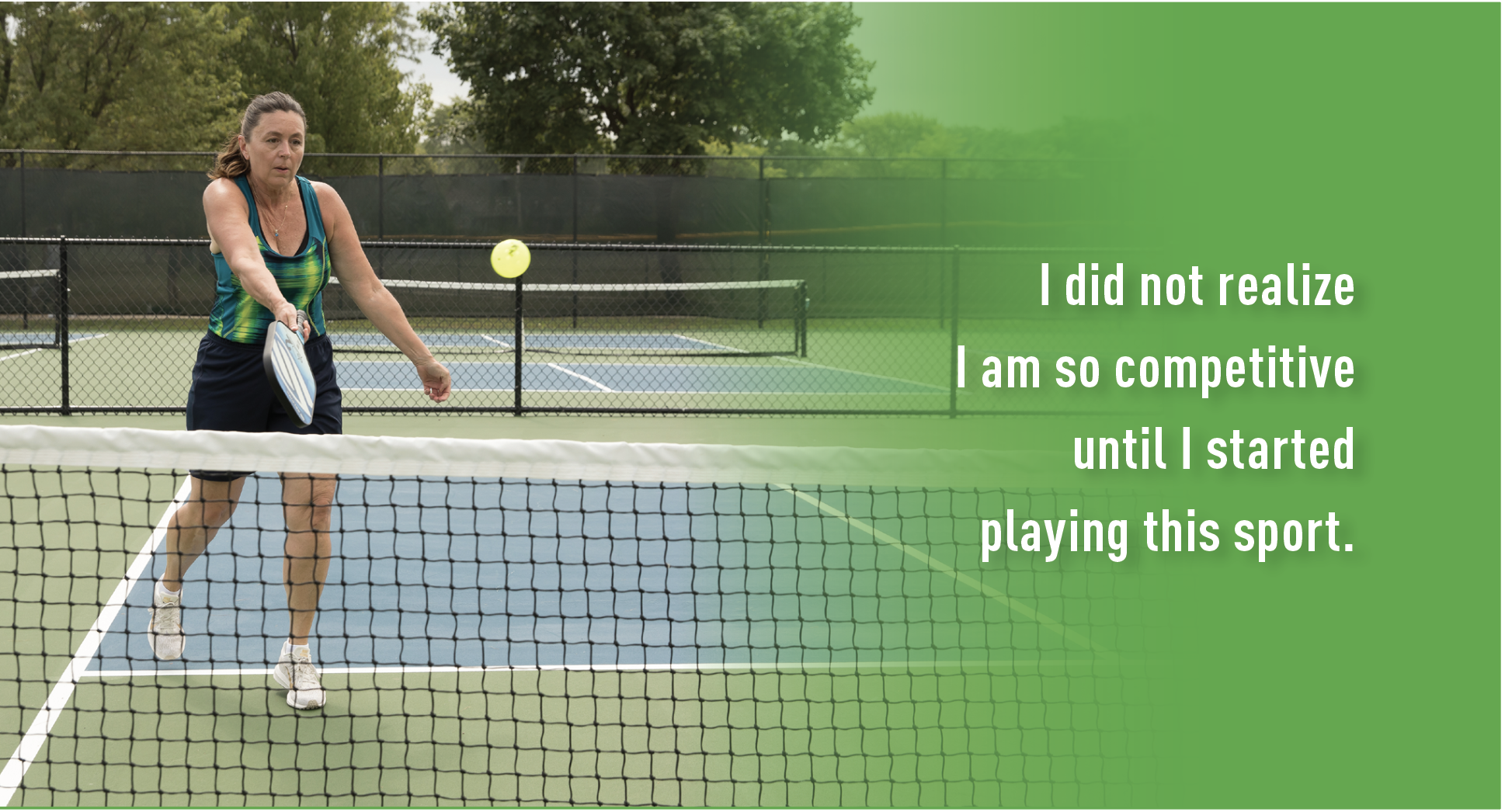

Pickleball is a fun way to get some exercise, while being competitive and having some fun. I would much rather be on a pickleball court than on a treadmill. We usually play doubles, so there are four people on the court for every game. Pre-COVID, it was not unusual to have six full courts and a few people waiting to rotate into a game.

I created the pickleball group that we call PB ‘n Jammers out of necessity. We needed a chat group to ensure that we could always find at least four people to play. Our group has grown to almost 100 people, and I thought the name was cute because we started playing music while we play.

I did not realize I am so competitive until I started playing this sport. My sister was more competitive and athletic than me growing up and always beat me in sports, games, and other competitions. However, I have learned that my personality in a tournament is much different and significantly more serious than when we are just playing for fun and exercise. I want to win! I’ve earned two silver medals but will keep striving to get the gold.

Then, I’m also passionate about my dogs. We always have at least two dogs in my home, and I was a trainer in dog agility for a while and have competed in dog agility trials. We also play Frisbee, and I train them to perform tricks. For example, my mini Aussie will jump into a suitcase if I ask him if he wants to go to Disney. He can also open a mailbox placed on the floor, deliver the mail to me, and close the mailbox. I currently also have a 1-year-old goldendoodle. He is adorable and a quick learner, and I am looking forward to seeing what he will learn and accomplish.

Q: How did you get into that?

HUGHES: Playing pickleball and training dog sports and tricks are the result of one of my continuous attempts to strike a work and life balance. We adopted two puppies in 2006, and I started researching activities and training opportunities. I am not currently training to compete with any of my dogs, but we play for fun and to keep my dogs healthy and happy. Likewise, I play pickleball to keep myself healthy and happy.

Initially, I trained with one of my standard poodles for about a year. He wasn’t the best agility dog in that he didn’t have a lot of drive. I think he did it because he liked being with me, and he wanted to please me. My poodle’s attitude was, “You want me to go through that tunnel again? I just did that.”

The owner of the training facility said, “I would really like for you to become an instructor. While your dog doesn’t always perform the best, we noticed that you take instruction well.” I think they chose me to become an instructor because of my fundamental approach to most things in life. I strive to master and often return to fundamentals to solve problems or create solutions.

My role as a trainer was to work with brand-new students to introduce them to the sport and basic dog training. I was actually training the people to be dog handlers versus training their dogs. A key to becoming a successful dog handler is to provide the right information to your dog at the right time to execute the next obstacle on the course.

Q: And the next few years look like they’re going to be quite busy.

HUGHES: I agree, the next few years will be very interesting. We will be dealing with the impact of the COVID-19 pandemic and its impact on the economy, banks, borrowers, and professional and social interactions, and also the impact of the CARES Act, increased attention to diversity and inclusion, and likely other events and influences of which we are not yet aware. However, just like in dog agility, my role as a financial advisor will be to provide the right information to my clients on a timely basis so that they can conquer the obstacles in front of them to maximize value for their creditors and best outcomes for the shareholders.